Looking for side hustle ideas to pick up so you can supplement your monthly income?

It’s always a good move to start a side hustle, especially if you are depending on only one source of income.

We see many instances where people just start a side hustle from nothing and scale it to beat their regular job income and end up leaving their primary job to focus on their side hustle turned main business.

So, if you are looking for those kinds of legit side hustle ideas, we’ve got you covered.

In this post, we’ve listed 45 proven and high-potential side hustle ideas that help you to earn extra money in your free and attain financial freedom eventually.

Depending on your hard work and execution, these side hustles can generate anywhere between $100 – $50,000+ per month.

So start working on the one that matches your skillset and executing well to achieve your side hustling goals.

And let’s discuss how to pick a perfect side hustle before jumping into the big list.

Note: We’ve done a ton of research to curate this 10000+-word long article to serve you with the best side hustle ideas. So if you feel this is long, you can bookmark this page or save it to come back later.

What Is a Side Hustle?

The Most Financially Successful Are Those Who Have a Rightful Backup SideHustle!

As the name itself suggests, a side hustle is usually a side job that people do in their free time to make some extra cash.

We can call it a secondary source of income as most people do it because their regular job doesn’t help them meet their income, expenses, savings ratio, or other career goals.

People usually choose a job that is easy to do and matches their skillset as a side hustle and do it after their 9 to 5 one.

Things To Note Before Considering Any Side Hustle Ideas

While having a side job to do gives you monetary reassurance, it is not just it. You must consider a few other factors, such as:

- Schedule

- Income Potential

- Your Interests and Skills.

Here’s a quick and clear view of what you need to do before getting started.

| DOs | DON’Ts |

| Invest quality time in your side hustle. | Make sure you don’t ignore your permanent job. |

| Use your free time to do your side job. | Don’t let your chores and side gig overlap. |

| Consider the job that interests you. | Don’t go for the gig that may make you feel like you have a 9 to 5 job. |

| Do your research to opt for the one that helps you progress financially and career-wise. | Don’t let the vast figures fool you. |

Make sure that the side gig you are going to choose is promising and will help you in the long run. Let us discuss more regarding how to get started with a side hustle in the upcoming sections.

Now, you have a brief idea of what to look for in a side hustle, so let us dive into the list of side hustle ideas available out there.

Best Side Hustle Ideas To Try From Home

1. Blogging

Income Potential: Up to six-figure income potential per month

Regarding the best side hustles from home, I suggest you start with what worked for me first.

Blogging is a promising side hustle that has a six-figure income potential and generates multiple sources of income for you throughout your journey. Feels surreal, right?

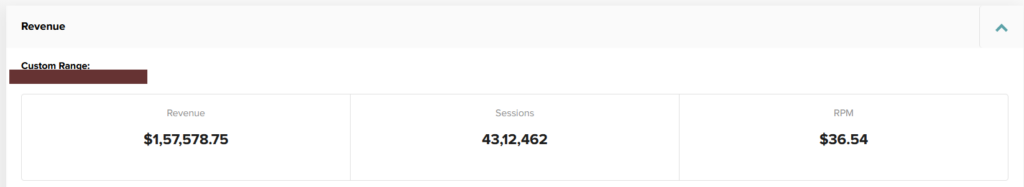

In the beginning, we thought the same, but just see the below stats where blogging placed us within a couple of years!

Overall Mediavine Ad Income

Note: This is only my Ad revenue; you can earn more than this with other potential ways like Affiliate marketing, Sponsored posts, courses, ebooks, etc. (Read how I generated nearly $400,000 from this blog.)

With a lot of passion, a little patience, and time you can go places with this gig, and at a point, you can just sit and earn without doing anything.

What Is Blogging And How Does It Work?

To keep it short and clear, blogging is nothing but creating a website where you share content about any particular topic in your style.

As you observe, mine is a finance blog where we discuss different money-making ideas, business ideas, and more.

Similarly, you too can choose a niche that interests you or that you have good command over and start sharing your knowledge with the world through your blog.

How Does Blogging Work To Make Money?

The income opportunities via blogging are endless, and this is one of the reasons for this idea being at the top of this list.

- Affiliate Marketing: You can promote products from different brands (who approach you to do it) using your own affiliate links, and when someone makes a purchase through that link, you will earn a commission.

- Sponsored Posts: Write about others on your blog upon their request and get paid for doing it.

- Advertisements: Ads displayed on blog pages will help you earn a good passive income.

- Selling a Product: You can create and sell a product related to your niche on your website.

- Selling Courses: You can create an online course and sell it to your audience.

So these are a few sources of income other than what you earn while people read your blogs. You get access to these income sources once your blog gains good reach and traffic.

By spending free time building a website after your permanent job and creating good content that attracts readers, you can make more than what you wanted from a side hustle.

And creating a blog takes less time than what it takes to decide and less investment than any other online business.

Literally, it takes only $2.95 per month to host a blog with Bluehost. (Which is way cheaper than our monthly coffee budget)

Guide To Start Your Blog In 20 Minutes!

That’s all; you are ready to launch your website and write and publish your articles.

2. Proofreading

Income Potential: Average of $50,000+ per year

Relax on your couch with your evening coffee, proofreading different things as you read your novel.

If you have a sharp eye for grammatical and punctuation errors, this is the side hustle idea for you.

So we said it all? No!

What Exactly Is Proofreading?

Proofreading is nothing but the final evaluation of a written piece before sending it to publication.

Much content is appearing online and offline these days; all this content will be clearly filtered with proofreading before publishing.

This implies that many more online proofreading jobs are open in this field, and you can also find freelance proofreading opportunities on job boards such as FlexJobs or Fiverr.

One more best thing about this job is you can do it anytime you wish, with no fixed timings.

It’s not just the ease that this job offers but the pay as well that makes it one of the most desired side hustle ideas. As a proofreader, you can bag around $20 – $50 per hour doing this simple job.

However, you might be expected to have certain skills for you to get hired. And these are what they look for in a person they want as their proofreader.

- Proper knowledge of Grammar, Punctuation, and Spellings

- Ability to concentrate

- Accuracy in work

- Time management and organizational skills

- Computer competence

- Attention to detail.

How To Start Proofreading Side Hustle?

Every side hustle needs our proper efforts to prosper well, and so is for proofreading too. You can start with learning fundamentals.

This gig is always thriving, and people like Catlin Pyle are an example. She started making six figures as a freelance proofreader and has grown so much in the field that she teaches thousands of people to do the same successfully.

You can grasp all the required fundamental knowledge by attending her FREE Proofreading Workshop that helped thousands of students to become full-time or part-time proofreaders. (Read the testimonials here)

Signup For Caitlin’s Proofreading Workshop!

Read – 9 Amazon Proofreading Jobs For Beginners – $20/Hr.

3. Online Voice Acting Jobs

Income Potential: Earn $50 – $10,000 per project.

Voice-acting jobs are always in high demand; this simple gig where you provide a voice to the characters or the advertisements can create wonders for marketing or product agencies. To be more precise:

Voice-acting jobs, popularly known as voice-over jobs, are where you contribute your voice to a commercial, cartoon, audiobook, videogame, or even for events, etc.

The availability of these jobs is always on the higher side, as many industries need voice-over actors. You can surely add this to your list of side hustle ideas if you have fluency and a decent voice.

Usually, these voice actors work in recording studios where they record scripts by reading out using microphones and audio equipment.

Changing trends also opened doors for online voice acting jobs where you can work in the comfort of your home.

But to perform from home, you must be well equipped with some needful things like a mike, stand, headphones, editing software, etc.

Skills Needed For Voice-Over Jobs?

- Must possess a clear and confident voice

- Optional degree in voice acting, theatre, or voice studies

- Well-versed in voice techniques

- Ability to control the voice pitch

- Eloquent script-reading skills

How To Become A Voice Actor?

If you are embraced with the above skills, you are halfway done to becoming a voice actor. What is the aftermath after this? Don’t worry. We’ve got you covered!

Being a beginner, you can try this FREE voice-acting course by Julie; she is highly experienced in this field and an authorized Audible producer.

This course can give you the foundation where you can hail high in this field and show your passion for earning fame and money at the same time. For what are you still waiting?

Join FREE Voice Over Mini-Course!

4. Paid Online Surveys

Want to monetize your fun time or smartphone usage? If so, online GPT sites will do the job for you.

Well, there are many scam GPT sites there to waste your time by promising hefty amounts of cash for doing simple short tasks.

On the other side, a few legit survey platforms actually compensate you decent bucks for answering surveys, shopping through their platforms, watching videos, playing online games, reading emails, and more.

Two legit websites everyone should signup for are

Swagbucks is a popular GPT site with more than 20 million+ users worldwide. It has paid over $890 million USD in cash rewards to date.

On a typical day, you can earn $5 – $10 using this app on your phone, and occasionally, you can also find offers that pay $50 – $250. Swagbucks offers a $10 welcome bonus to all new users & you’ll get $3 per each person you refer to join Swagbucks.

InboxDollars works similarly to Swagbucks, and this site has also paid over $80 million USD in cash rewards since its inception.

You can earn as much as $20 per survey, while the average survey earnings on this site vary between $0.5 – $5. Having plenty of other ways to earn on InboxDollars other than surveys is what makes this site so special. Get a $5 instant signup bonus when you signup.

Both websites allow users to cash out their earnings via gift cards or PayPal money. In case you want to explore more survey sites that pay instantly, here are a few more websites according to user ratings…

By signing up for one or multiple websites and grinding on the best offers, you can bag around $200 – $300 per month from this side hustle.

Note: Remember, this is totally a fun time side hustle to monetize your time spent on your smartphone. We don’t recommend investing your active hours as they don’t give you a reliable income.

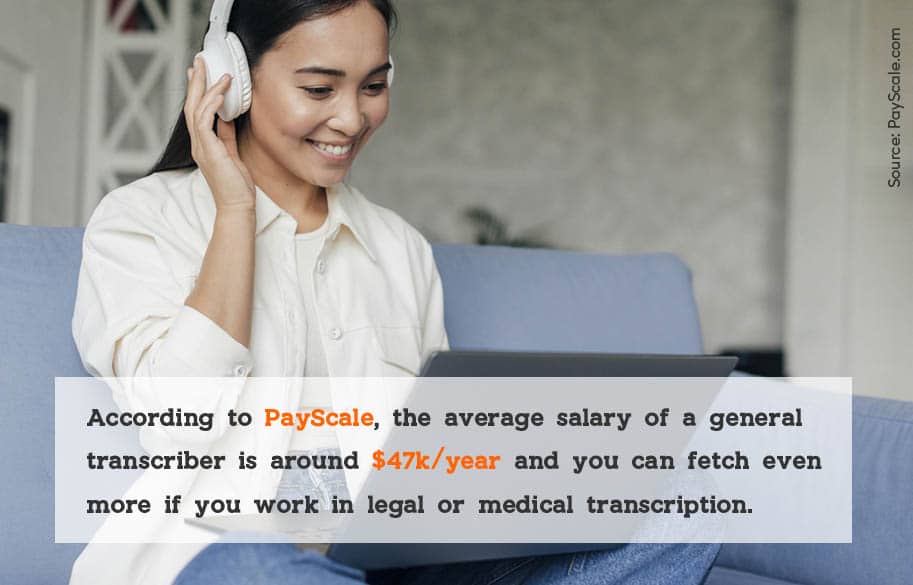

5. Transcriptionist

Income Potential: Earn An Average of $47000+ Per Year.

One more profitable and no-commute job that is perfect for those looking for part-time jobs is a Transcriptionist.

Who Is a Transcriptionist?

As a transcriptionist, you will be typing down the content in audio files by listening to them. This process is called transcription. Usually, there are three types of transcription:

- General Transcription: As the name suggests, you will be transcribing general audio files such as interviews, research audio, podcasts, etc.

- Medical Transcription: Transcribing the voice reports dictated by physicians, nurses, or notes taken during medical lectures, etc.

- Legal Transcription: Converting the audio files of legal proceedings, etc., to text format.

Transcriptionist Eligibility Criteria

Transcription is a job that has to be done with a lot of precision. The audio and text you will be converting into both of them should be the same in all terms starting from punctuation to tone.

This is the reason businesses hire people only with these special set of skills that are listed below:

- Typing speed and accuracy

- Good listening skills

- Attention to detail

- Ability to identify oral punctuation

- Knowledge about the transcribing terminology

- Lots of concentration, etc.

Got these skills in you? Jump right now to job boards and find some well-paying part-time transcription jobs for yourselves.

How To Become A Transcriptionist?

Even if you have not got them all, you can still get into this field by joining and learning from the right courses available.

One which tops the list is a Free Seven Lesson Mini Course by Janet from TranscribeAnywhere.

Enroll in Free Mini-Transcription Course Now!

Read: 14 Legit Online Typing Jobs To Do From Home – [$30+ Per Hour].

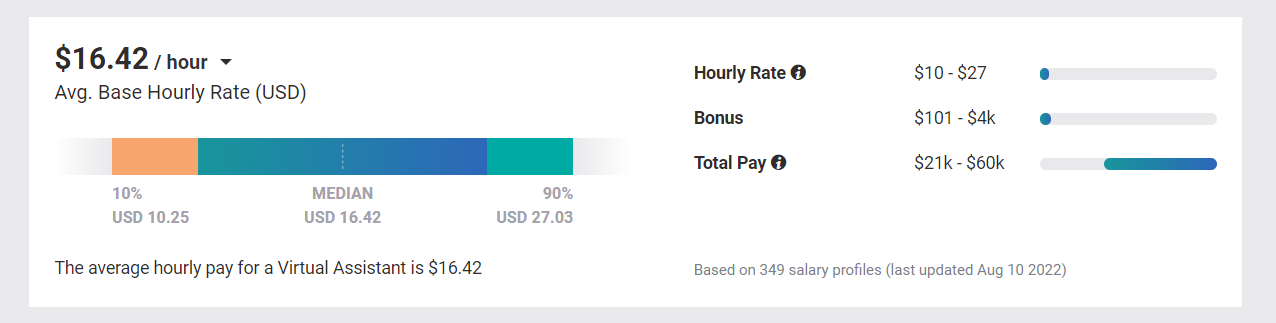

6. Virtual Assistant

Earning Potential: $10 to $100 per hour

Another remote job on this list of side hustle ideas is that of a Virtual Assistant. As the name suggests, you need not be physically present at any particular place to offer VA services.

Usually, a Virtual Assistant helps with different administrative tasks such as scheduling meetings, attending phone calls, organizing emails, handling social media accounts, etc.

This business can finely be a freelancing where it has equal potential as your full-time job. You can make up to $50 an hour.

Being a virtual assistant for a few hours a day, you can earn up to $500 fast in a week. To offer VA services, you are supposed to have a set of skills; cross-check the following and apply for one if you possess them.

- Experience in MS Office

- Scheduling(for example, familiar with Google Calendars)

- Time management skills

- Strong phone etiquette

- Email communication skills

- Organizational skills, etc.

How Much Can I Make From Virtual Assistance?

You will earn depending on the task you fulfill and the length of time you work. Some people earn as much as $10-$100+ per hour by offering virtual assistant services. Yes, that’s true!

Where To Find Virtual Assistant Jobs?

Since you are choosing this as a side hustle, you can find virtual assistant jobs on different freelance websites such as Fiverr, Upwork, or FlexJobs.

Check out this virtual assistant course by Gina Horkey, who helped hundreds of students to land their first client within 30 days of training.

Read – How To Start A Virtual Assistant Business With No Money?

7. Make Money Playing Games

Income Potential: Earn $100-$1000 Per Month

Gaming can really improve our cognitive as well as logical skills. It is said that, on average, a person spends more than 2 hours a day using his mobile, but the cache is how productive are we using these hours?

You need not always spend time on educational data, sometimes spending your time playing stress-busting games can also help you earn money; here is how:

Game Apps That Pay Real Money

If you have a full-time job and cannot dedicate much time to play games, these below-mentioned games can help you earn a few bucks in minutes.

- Blackout Bingo: Enjoy unlimited bingo games and earn real money with no interruptive ads.

- Solitaire Cube: Play solitaire and compete with real players to earn money and rewards.

- Poolpay Day: Earn exciting prizes and cash that can be redeemable through PayPal or Apple.

- 21 Blitz Game: Try this skill-matched game to complete challenges for real-time rewards.

- Dominoes Gold: This classic board game can help you earn huge rewards for scoring high.

Other Ways To Earn High From Games

Online gaming is not only limited to a few smartphone apps. You can also build a full-time gaming career over it.

Here are a few ways to make gaming your full-time income. These ways need lots of patience and dedication to gain real-time results.

But once you are succeeded, there is no way back from there.

- Start Your Own Gaming Youtube Channel.

- Stream Your Gaming On Twitch.

- Start A Blog And Review Games.

- Become A Gaming Influencer

- Give It A Try For Own Gaming Merch

- Open Your Own Gaming Store

- Start Selling Your own Digital Gaming Products

- Participate And Conduct Live Gaming Contests.

What’s Next: You can start with our list of real game apps that pay real money. Still have trouble starting, reach us in our comment section to learn more side hustle ideas.

Read – 43 Cash App Games That Pay Real Money

Side Hustles That Pay Well

8. Freelance Writing

Income Potential: Earn $50 – $1000+ Per Article

Good with words? Think no further and use your free time to write for magazines, blogs, etc.

Stats show that 91% and 77% of people read magazines and blogs, respectively. These stats of readers implicates the demand for writers.

Businesses or organizations hire only a limited number of writers on a regular basis but look out more for freelance writers because their requirements, like the writing style, etc., change from one subject to another.

Hence, you will always find a writing opportunity at one place or another through different job portals.

If you are a beginner, this is the first thing that may strike your mind. But let us tell you that apart from just blogs and magazines, there are other many other writing opportunities, such as:

- Business Email Writing

- Creating newsletters

- Writing articles for local media

- Write for your town’s newspaper

- Reviewing different things such as food, places, etc.

How Much Can I Make From Freelance Writing?

While it depends on different things like the subject, the word count, etc., a freelance writer has the span to make a six-figure income.

As a beginner, you can expect around $20 an hour or $30- $50 per 1000-word article. Too good to be true, right?!

But that’s, in fact, true, and you can check out people like Holly Johnson, who have achieved the milestone of earning $200,000+ per year being a freelance writer.

Read: Get Paid To Write: 150+ Sites That Pay You $50-$1000 Per Article.

9. Offer Bookkeeping Services

Income Potential: Up to $53,625 per year

If you are in the commerce field, you must be aware of the importance of bookkeeping in running a business.

Many startups and small businesses are entering the market every day. They may not be familiar with maintaining an account of their transactions or may need someone to do it for them.

You can approach them to offer your bookkeeping services.

What Is Bookkeeping?

Bookkeeping is a part of accounting that involves collecting and maintaining all the records of the financial transactions of a business.

A Bookkeeper is a person who does this activity and is responsible for doing it daily to maintain up-to-date and accurate financial records.

Some jobs of a bookkeeper are as follows:

- Filing receipts

- Recording expenses

- Handling bills and payments

- Managing payrolls, etc.

Bookkeepers bag around $30 an hour on average, and if you are experienced and serve big companies, your hourly rates will be around $60 – $100 an hour.

Read: 13 Best Bookkeeping Jobs That Pay Up To $60 Per Hour

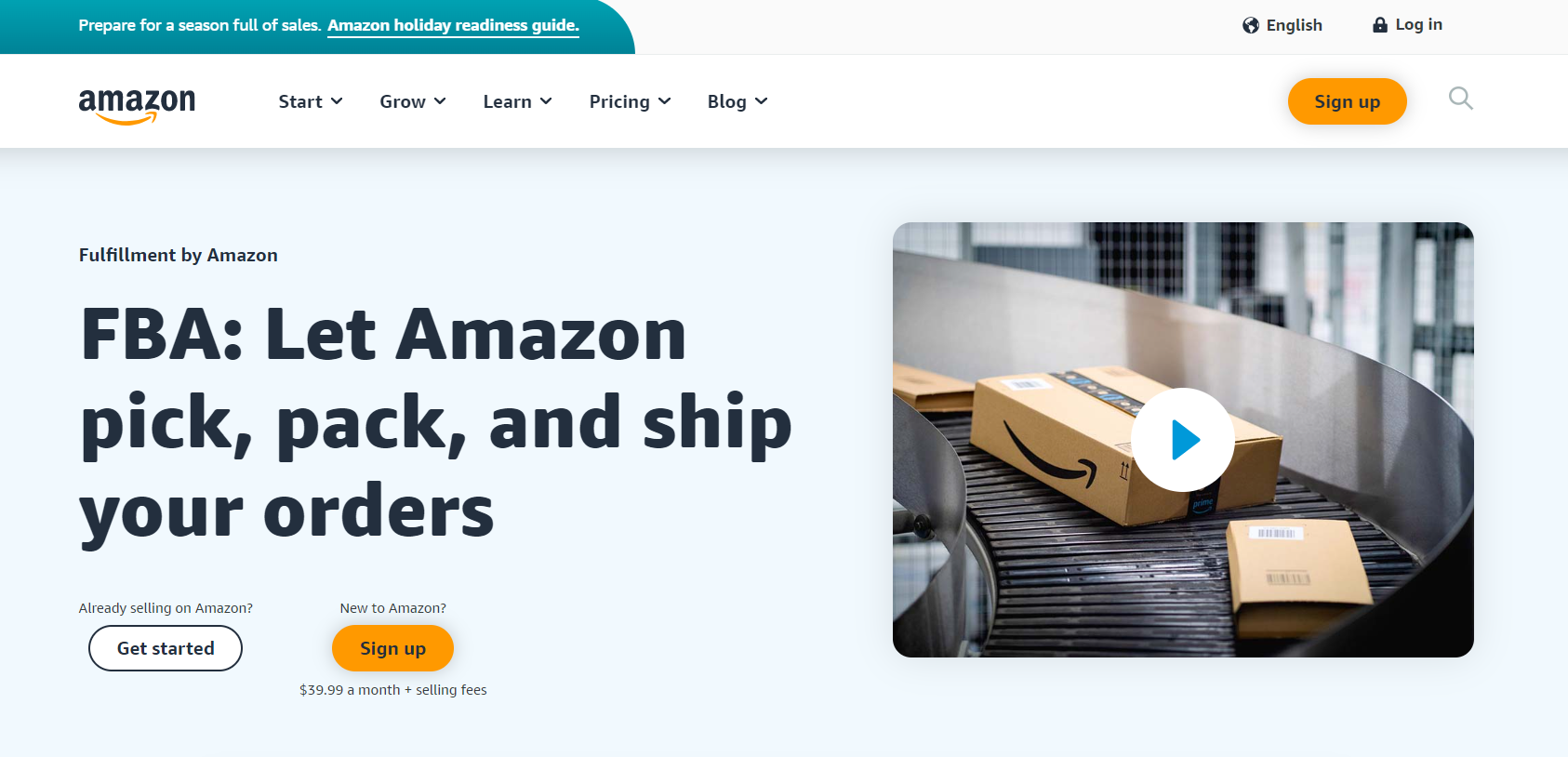

10. Amazon FBA

Income Potential: $100 to $100,000 per month

Amazon offers many work-at-home opportunities for Amazon users, but FBA is a business opportunity that separates itself from all other opportunities.

Is anyone interested in selling a product but couldn’t do it because of your tight regular job schedule? No worries. Amazon FBA is there for your rescue.

Abbreviated as Fulfilled By Amazon, FBA is a fulfillment program by Amazon where you sell your product, and the rest is taken care of by Amazon.

This is the best track for those who want to side hustle by selling things online because you sell, and Amazon packs, ships, and fulfills the order.

How Does This Work?

Selling through Amazon FBA is as simple as purchasing on Amazon. However, it involves the following steps:

- Creating an Amazon selling account

- Log in and set up your FBA

- Listing your products and specifying the inventory

- Sending your listed products to Amazon fulfillment centers

Once all these are done and your products reach the fulfillment center, they will be available for buyers. And when someone places an order, amazon packs and ships it to them.

Amazon FBA program provides some more benefits like:

- Trusted customer service

- Returns facility

- Order cancellation

- Tracking and monitoring your shipments, etc.

FBA costs a little charge per unit for offering these services.

With a bit of guidance, any of you can make the most of this lucrative opportunity, just like Jessica, who made a whopping profit of $100,000 during her first year of starting this business, that too by working for just 20 hours per week.

Read – Make Money on Amazon: 15 Ways To Make Up To $5000 Per Month.

11. Start Your Youtube Channel

Income Potential: Varies with ads and viewership

You all know how people are into visual content these days, and YouTube is the best place to cash this demand.

YouTube is the second most visited website, with 14 billion monthly visits and an average of 19 minutes of viewership.

So why watch YouTube when you can earn by posting your own videos on this ever-trending platform?

You must have competence over a task or information to share about something. You shoot all of that into videos in your downtime and post them on your YouTube channel.

Once your channel gains 1000 subscribers and 4000 watch hours within a year, you will start earning through it.

Though you need to work hard to reach this target initially, the future revenue you will generate will be worth it.

How To Make Money On YouTube?

Once you have the required following, multiple income sources get generated via your youtube channel for you.

A few of them are as follows:

- Ad Revenue: The ads you get to watch before AdSense generates the video starts, and you will get paid 55% of the revenue generated through the ads that play before your video.

- Sponsored Videos: Brands will pay you to promote their products in your videos.

- Affiliate Income: Brands also pay you a commission when people make a purchase using your affiliate link for the product you recommended in your video.

- Selling Products: You can generate sales for your own products by showcasing them in your videos.

When certain videos go viral, you keep on making passive income through them.

Read – 16 Unique Ways To Get Paid To Watch Netflix

Side Hustles With No Experience

Changes in earning patterns and increases in the cost of living are always pushing us to our extremes to cope with our expenses. What is the solution for this evergreen spiking trend?

Adding rightful side hustles to the full-time income, isn’t it? Check out these awesome side hustle ideas to start with no experience.

12. Try Dropshipping

Income Potential: Varies Along With Your Sales

The best thing about Dropshipping is you sell products but won’t have to do anything with the inventory, which is a great relief for any seller.

And it is this feasibility that has made dropshipping gain a place on our list of side hustle ideas.

You have read about Amazon FBA above; dropshipping is similar to it, but the only difference is that you will be responsible for creating your store and scaling your business, and hence you won’t be charged anything.

Apart from growing your business, most things like customer support, handling returns and forwarding them to your supplier, etc., must be done yourselves.

All of these might look hectic in the beginning, but with the right resources and time, you can pull it off easily just in your downtime.

How Does it Work?

Dropshipping, in simple terms, is reselling. You will be selling someone else’s products on your online store and forwarding the orders to the owner of the products.

They will take care of the rest, like packing, shipping the order, etc.

To become successful in this gig, you need to take care of the following things:

- Finding a trusted supplier whose products you can resell

- Creating an online store to sell the products

- Creating a smooth system to fulfill orders on time.

Read – 37 Most Lucrative Resin Crafts To Sell [$100+ Per Item!]

13. Sell On Etsy

Income Potential: Varies with sales on Etsy

Etsy is a place for unique goods such as handicrafts, home decor, handmade accessories, etc., making it a go-to place to buy aesthetic stuff. We see millions of people shopping for a lot of things on this highly buzzed platform.

However, most people might not be aware that Etsy is not just for buyers but also for sellers. So if you have that innovative quotient, start developing a product that’s demand worthy and post it on Etsy for people to buy.

This platform is the most suggested to sell handmade goods and crafts because they take care of everything while you concentrate on making beautiful and quality products.

This is how you can start selling on Etsy:

- Create a Seller’s account

- Choose a plan, either Standard or Plus, according to your requirements

- List your products

- Use a wide range of tools available to optimize and grow your shop.

It is that simple. However, you need to pay small listing fees to list products and a transaction fee of 6.5% per sale.

You can also buy and sell used stuff on websites like Poshmark or Facebook Marketplace to earn a decent side income.

Read – 25 Easy Money-Making Crafts To Sell Online

14. Sell Stock Photos Online

Income Potential: 15% to 45% Royalty

Spend your free time by turning your favorite hobby of taking pictures into a side hustle. You can work on anything you like and still make money using them.

Wondering how?!

Source: GettyImages

Do you see those pictures on websites, online stores, or other advertisements? Not all of them are shot by the respective owners. Most of them are usually bought from stock photo websites and used accordingly.

These stock photo websites usually purchase the work of different photographers, post it there, and pay those photographers a commission every time somebody downloads their photo.

So if you have got an eye for photography, cash it out by selling your work on such websites.

Some of the best stock photography websites to sell your photos are:

Though you sell photos to these websites and people keep downloading them, the best part is you will retain ownership over them and can claim it anytime.

Read – 22 Best Platforms To Sell Photos Online

15. Flipping Stuff

Income Potential: Depends on Flip Conversions

As the name itself suggests, Flipping is to buy and sell a product immediately to make huge profits.

But it is not as simple as it sounds because you need to know different things like:

- what kind of products are people willing to invest money in

- places where we can find good products for less price

- Pricing strategy

- Marketing the product, etc.

Once you become well aware of such things, then flipping products could be the best side hustle for you to do.

Best Items To Flip For Profits

What’s Next In Flipping?

If you are completely new to the field of buying and selling, you need to have proper guidance from experienced people in the flipping business, such as Rob & Melissa, who made more than $133,000 in 2016 by flipping things.

You also have total freedom to do this gig whenever and as much as you wish, making it one of the best side gigs for anyone.

Read – 15 Places To Sell Sneakers For INSTANT Cash

16. Run A Food Truck

Income Potential: Relative to your food sales

All good home chefs out there, this side hustle idea is your call to pursue your passion and make some extra bucks today.

People usually binge eat street food during the evenings, so you can make cash by starting a food truck.

We suggest investing in a mobile food truck to cook for people rather than other ways because:

- Less investment compared to starting a hotel or restaurant,

- You can move to different places, and hence becomes easy to find the place of demand,

- Free marketing as your truck goes around the city,

- People resort to such food trucks more to quickly satisfy their tummy and taste buds.

You can cook and sell anything ranging from fries to pizzas.

We also see barbeque trucks these days, which only implies that there is no limitation to what you can cook and sell on a food truck.

So with lots of zeal to cook and a little investment to put in, start your part-time food business now.

Side Hustles For Women

17. Teach English Online

Income Potential: Upto $26-$40+ per hour

The market for e-learning is constantly increasing; when it comes to teaching, women learn more interest and feel highly comfortable teaching students online.

There are several countries across the globe looking for native English speakers to teach their kids the language. Use this opportunity to add some teaching skills to make a reasonable income.

Eligibilities before you apply to any online English teaching job:

- You must be a native English speaker,

- Good teaching skills,

- Personal computer with reliable internet connectivity and webcam.

Where To Find These Jobs?

You can find online English teaching jobs on different dedicated learning platforms like Magic Ears.

This is an accredited ESL certification program where you will teach mostly kids of age 4 to 12 on a 1-on-4 basis.

You have the flexibility to work whenever you wish in a day and can make $20 to $26+ per hour, along with the finest added opportunities.

Read: 16 Best Platforms To Get Paid To Teach English Online

18. Offer Tutoring Services

Income Potential: $10 to $30 per hour

Use your knowledge to impart knowledge to others. If you are well-versed in any subject and have good teaching skills, then there is someone every time in need of your tutoring services every day.

From school subjects to postgraduate courses, arts or crafts, etc., you can teach anything under the sun in your free time.

Competitive exam courses are more in demand comparatively and can pay you up to $50 an hour. You can also teach the subjects related to your job if you are keen on it.

Without delay, set up a tutoring center at your home and start earning now if teaching is your thing. You can also offer online tutoring services as well.

If you are a student who is looking for tutoring jobs, you can also earn decent bucks by doing homework for others, selling your college notes, and selling your textbooks too.

19. Babysitting/ Childcare

Income Potential: An average of $10-$20+ per hour

Who doesn’t love spending time with kids? These pure souls are always a source of joy and the best stressbuster for anyone.

This is one of those side hustle ideas that are more suitable for young people above 18 years, so anyone who is a college student must definitely try this out.

As a babysitter, you are expected to spend time with toddlers making them feel comfortable and ensuring they are safe.

If you think you can meet these requirements, you can find babysitting opportunities online by signing up on websites such as UrbanSitter.

Read: 10 Best Babysitting Jobs for Kids Lovers To Earn

20. Become a Makeup Artist

Income Potential: $7.25 to $94.45 per hour

Do you love doing makeup for yourselves and for others? Then you should definitely consider being a freelance makeup artist.

There’s a lot of demand for make-up artists these days, especially during weddings.

You can draw those offers by exposing your skills on your social media accounts and providing your details to contact you for bookings.

Moreover, there are no strings attached to getting into this biz apart from having some good makeup tools and cosmetics.

21. Start A Podcast

Income Potential: $50-$1000+ Per Podcast

The way we consume content has been evolving every day, and podcasts are the latest among them. In this ever-hustling generation, people mostly consider listening to podcasts to learn new things.

So if you have some exciting things to tell along with some added communication skills, you can start a podcast.

Though this requires a little investment, you will be making the most out of it in the form of sponsor deals, advertisements, etc., once you gain a good number of listeners and downloads.

Use your free time to work on it. You can do good even by airing at least one episode a week.

Read – 18 Ways To Make Money Podcasting (Fit For Gen-Y)

22. Organize Stuff

Income Potential: $21 to $27 per hour

In this busy world, where everyone’s in a rush with their studies, career, etc., in their lives, most of them don’t find time to organize things in their home.

You could make use of this opportunity and help them organize their house as a professional organizer if you were organizing skills.

This may sound unreal, but businesses are dedicated to helping people with this task. So why don’t you do it on a freelance basis to generate some side income for yourselves?

You can market your service on your website and other social handles, and we are sure you will attract your first client soon because that’s how the demand is.

Other Ways For Females To Make Money Online/Offline

- Open an online consignment store

- Start a laundry or cleaning service

- Get paid to lose weight

- Try to be a personal chef

- Get Paid To Type

- Start Your own beauty side hustle

- Get Paid to Chat Online

- Get paid to stitch, knit, or embroider

Best Gig Economy Side Hustles

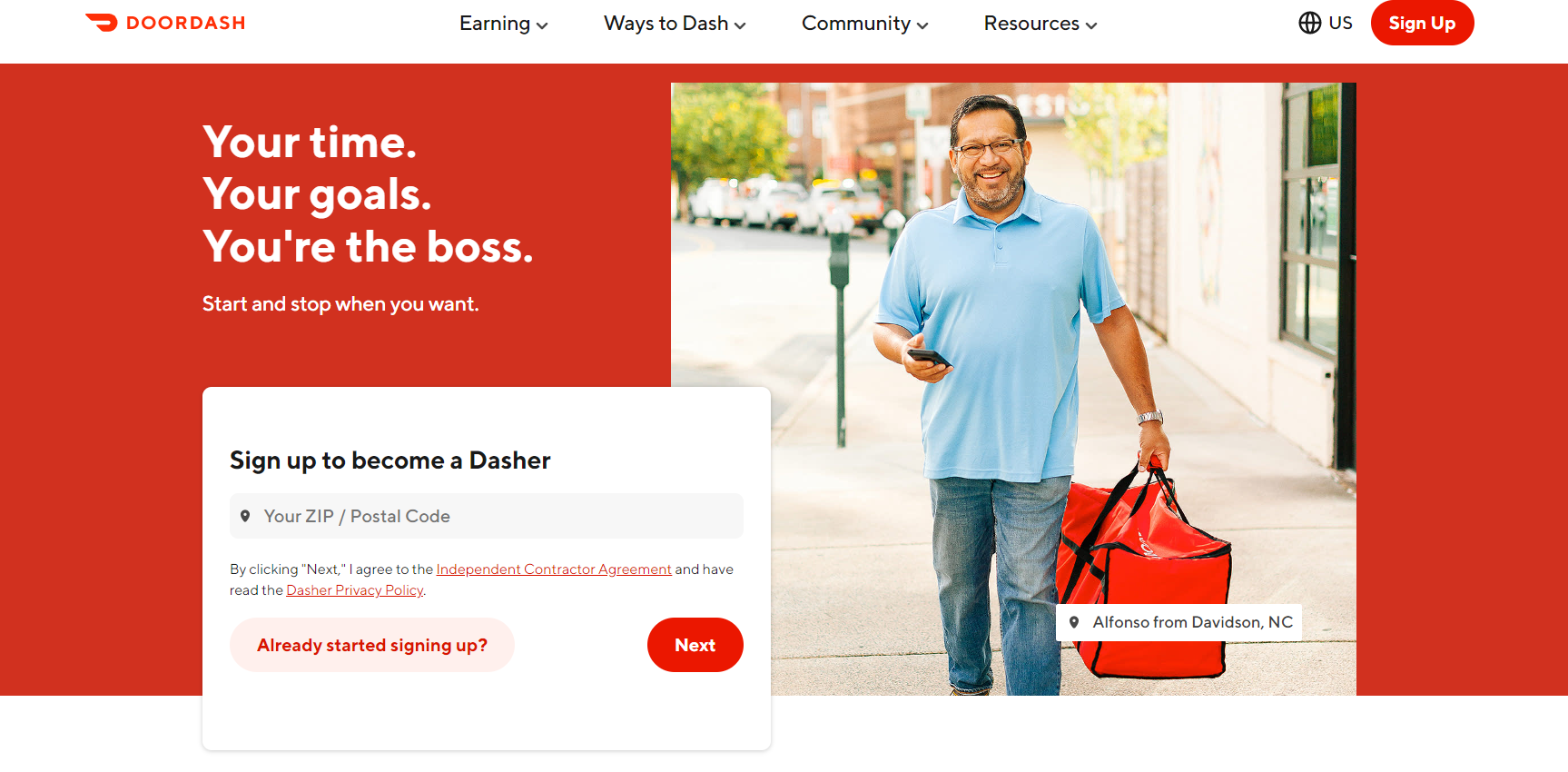

23. Delivery Driver Jobs

Income Potential: $15 – $25+ per hour

With people shopping for everything online, the need for delivery agents is only going high day by day. Go for a drive around the city in your free time by getting into a delivery driver job.

You can choose to deliver anything from food to groceries, etc., from the different options available.

All you need to have to do this side job is a vehicle and a driving license. The best thing about these jobs is you can work your flexible schedules and deliver as many orders as possible.

Where To Find These Jobs?

You can find delivery driver jobs on platforms like DoorDash and Instacart.

Thanks to technology, there are now apps dedicated to delivery drivers through which you can apply and start working.

DoorDash is one food delivery platform in the US that hires delivery drivers to deliver food from the nearest restaurants.

Delivery drivers at DoorDash are called Dashers and can deliver on any vehicle, from a bike to a car.

Dashers earn decent cash anywhere from around $15 to $25 per hour. All the payments are made weekly directly to the bank account.

DoorDash offers a Fast Pay feature that pays anytime, making it one of the best jobs that pay daily. By spending a few hours a day, you can easily fetch $500 a week with DoorDash.

Make use of these DoorDash hacks to increase your hourly pay rates in low order times.

Instacart is another great alternative delivery job like DoorDash, where you need to shop for groceries and deliver to customers to earn up to $25+ per hour.

24. Be a Handyman On TaskRabbit

Income Potential: $15 to $30+ per hour

If you don’t mind helping others with different daily chores, you can choose to be a Handyman in your free time.

Platforms, such as TaskRabbit, have handyman opportunities. These platforms are online marketing places that match daily tasks in a locality with a handyman.

The tasks may include delivering goods, cleaning, furniture assembling, etc. Though the pay depends on the task you do, you can make more money doing more tasks.

Also, you have the flexibility to choose whenever you wish to work. So if you are somebody who doesn’t have a fixed free time, you can take up this gig.

25. Pet Sitting

Income Potential: $20 to $40 per day

Spending time with animals is undeniably rejuvenating. So go for a stroll down the city in the evenings along with a dog or take care of pets that are, of course, not yours.

People on vacation or away from the city usually pay to take care of their pets in their absence. You can approach them and take care of their pets to earn that extra cash.

There are different requirements under pet sitting, which may include the following:

- Keep the pet at your home overnight

- Spend time with their pet at your house throughout the day

- Drop by to play with the pet, etc.

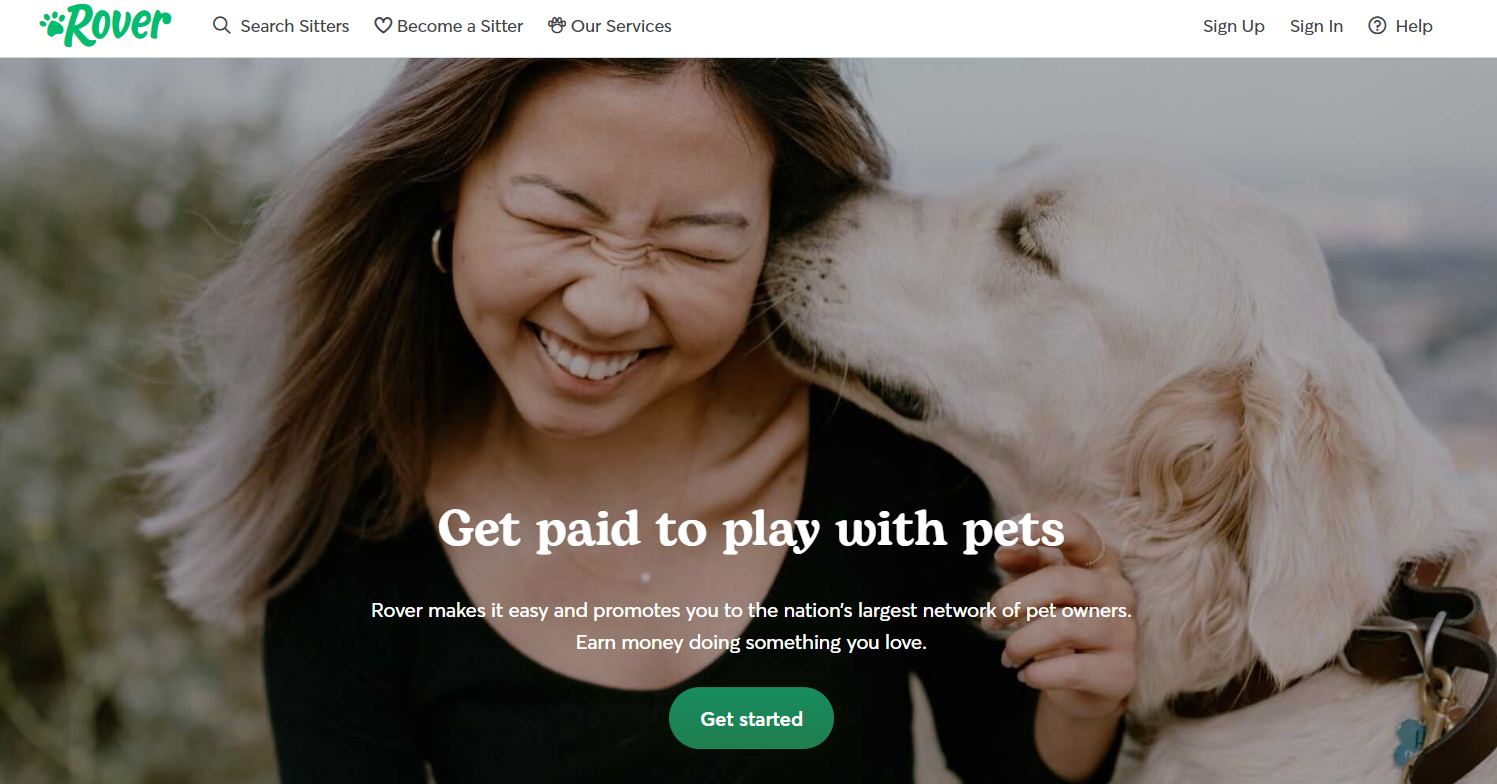

Where To Find Pet Sitting Jobs?

You can find pet-sitting jobs on websites like Rover, where pet parents post their requirements.

These websites are a dedicated bridge between pet parents and sitters. You can sign up as a pet sitter, fix your schedules, and choose a flexible gig.

26. Try Part-Time Remote Jobs

Income Potential: Varies With Job

Remote jobs are the best ones to do if you are looking to work, irrespective of the location you are in or if you don’t want to commute to work.

There are part-time opportunities in many areas, including writing, sales support, video editing, etc. Apart from the eligibility, all you need to have to take up a remote job is a laptop with good internet connectivity.

Where To Find These Jobs?

For part-time jobs, you can refer to job portals such as:

You can signup for any of these freelance job portals to gain complete access and notifications about all the latest opportunities available.

Recommended:

25+ Online Jobs For Introverts To Work At Home – Earn $5000/Month.

20 Best Remote Typing Jobs That You Can Start.

27. Print And Sell T-Shirts

Interesting Fact: The global T- shirt printing market was worth USD 3.9 billion in 2021 and is expected to rise at a compound annual growth rate (CAGR) of 9.9% between 2022 to 2030.

The above figures reflect how promising this business is, right?!

Put in all your creativity to make some eye-catching designs to print on t-shirts and sell them to prospective buyers. You can market your designs on social media handles such as Instagram to reach more people.

While this gives you passive income, you can also move forward by printing your designs on t-shirts in small batches. You can earn a small profit on each unit, which will add up to become notable extra cash.

Taking up bulk orders from brands is also a great way to make that side income. You can even start your own printing service over time if your work makes a place in the market.

Some of the best places to print and sell t-shirts include:

Note: Here, earnings are highly varied along with your sale conversions.

Online Side Hustle Ideas For Beginners

28. FB Ad Managing Expert

Income Potential: $20 to $100 per hour

Recently, people largely depended on the seamless marketing experience that Facebook provides to develop their businesses.

Facebook Ads is a powerful tool that can change your business’s game, but many people need it but don’t know about using it. It’s here where the role of Facebook Ad managing expert comes in.

You can offer such businesses to help with their marketing work and earn if you have expertise in the following things:

- Setting up Facebook Ads

- Creating successful marketing strategies

- Managing social media campaigns, etc.

To put it briefly, you must be able to draw more customers and sales to your client’s business with your marketing work.

This job is not a scheduled one, so you can do it whenever you are free in your day.

Recommended: 18 Legit Ways To Earn Money On Facebook (Meta)

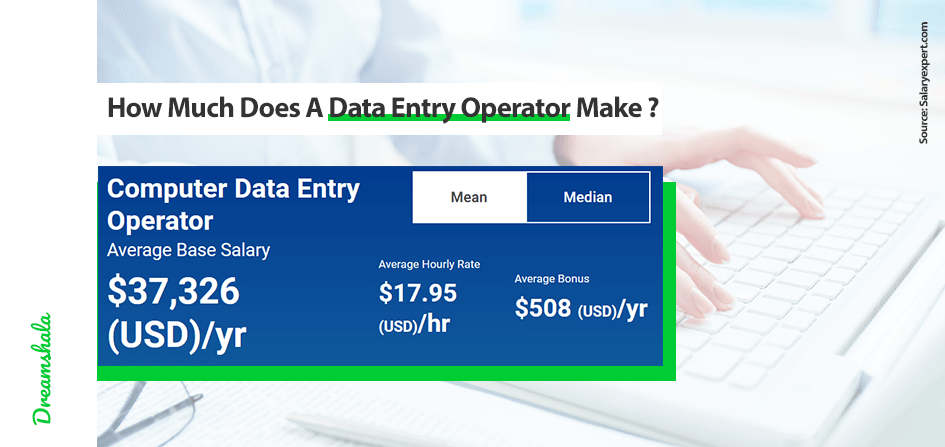

29. Data Entry Clerk

Income Potential: $10 to $20 per hour

That one part-time job available throughout the year is Data Entry jobs. You don’t need to have major qualifications to do this job except for a PC and typing skills.

Moreover, this is a remote job, so that you can do it in your free time and even on your vacation. And anyone, from working professionals to students to stay-at-home moms, etc., can do this job.

Though this job is flexible, you need to find reliable offers. Just be aware of scams and move forward.

Read – 13 Online Captcha Entry Jobs For Solvers: Earn $50 Daily.

30. Flipping Domains And Websites

Income Potential: Varies along with flipped price

Well, there are many ways to make money online; flipping domains and websites involves investing in the right products and selling them for profits when you need money quickly.

You must have seen people flipping houses or other products and making huge profits. Similarly, flipping domains and websites is a beneficial practice to make a viable side income.

Domains are an exceptionally profitable element of online real estate, so your income potential is always going to be decent and even high if you can choose domains with huge potential.

We think this is one of the promising side hustle ideas if you can invest money to search and register domains and then sell them all in your downtime.

To learn what things to flip to make it a profitable business, Opt for this free Flipping Course by Flipper University.

31. Graphic Designing

Income Potential: Earn $25000-$48,000+ per annum

Design is the route to reach a maximum number of clients for businesses these days. You can make cash from this necessity if you have good design skills.

Like the big and established companies, small or start-up companies may not have a design section of their own.

You can reach out to such companies and help them gain exposure by offering your graphic designing services in your downtime.

Hands-on designing software or tools such as Photoshop, Illustrator, Canva, Inkscape, etc., can help you attract more clients.

If you are familiar with the basics, you can join trending designing courses to get started.

Read: 20 Most Unique Places To Find Freelance Design Jobs.

32. Design Websites

Income Potential: Earn $100 – $10000+ per project

Technophiles, this is your chance to make a side income by spending your downtime doing what you enjoy.

With some businesses budding up every day, there’s always a need for web designers. Since these are start-ups, they can’t hire a full-time designer.

You can fill this gap by providing freelance web designing services. Use your knowledge of building websites to help businesses get online.

A few skills you need to have to excel as a web designer include:

- Knowledge of basic designing tools

- Visual design

- HTML and CSS

- Javascript

- UI/UX knowledge, etc.

33. Sell Digital Courses

Income Potential: $1500-$4500+ per month

Another way to earn through teaching is to sell digital courses online. While teaching students as a tutor, you may not be able to teach everything you want beyond the students’ syllabus.

A digital course gives you the freedom to teach everything you want to teach about a subject.

Moreover, creating and selling digital courses generates a passive income for you, which is a win-win situation for those who look for financial flexibility by doing what they are passionate about.

You can create a course on any topic under the sun and post it on your websites or course-selling platforms. Do check out the following popular platforms that can help you sell your digital courses:

Side Hustles That Pay Hourly

34. Search Engine Evaluator

Income Potential: Earn $30-$50 per hour

You can be a search engine evaluator if you are well acquainted with current events and social media trends, along with ample research skills.

As a part of the job, you will be providing feedback on the quality of results to the designers so that they can optimize the search results accordingly.

You can approach start-ups and small businesses either through email marketing or job boards like FlexJobs to offer your Search engine evaluation services.

This is a side hustle you can do from your home or any part of the globe if you have a good computer with reliable internet connectivity.

Read: 7 Best Search Engine Evaluator Jobs That Pay $15-$20 Per Hour

35. Testing Websites

Income Potential: An average of $25 per hour

A website tester job is something that doesn’t have a fixed qualification requirement. If you are well versed in using a computer and have some reasoning and logical skills, you can consider testing websites in your downtime.

As a website tester, you will be going through an assigned website like a normal user, noting any issues found and forwarding them to the developers. In short, you will be helping the developers make the website user-friendly.

Tech geeks would enjoy doing this job, and if you are one, grab this opportunity. A degree in computer science and an understanding of testing tools would help you grow further.

Apart from these online testing gigs, you can also try other product testing jobs such as…

36. Drive With Uber/Lyft

Income Potential: $15 to $25 per hour

Go for a ride around the city after your day job and make money while doing so.

Most of you might know how to drive, and if you own a vehicle too, you can opt for driving jobs as your side hustle.

You can sign up as a driver with driving apps to start your part-time driving gig. A few such popular apps include:

- Uber– You can drive your customers or just be a delivery driver.

- Lyft– Drive your own car or rent it for others to drive.

It is hassle-free to drive with these apps, as you can choose the time, where, when, and how you want to drive.

Related: 14 Best Delivery Driving Jobs For Retirees – Earn up to $20/Hour

37. Car Servicing

Income Potential: $10 to $15 per hour

You must definitely be spending most of your time learning all about cars and maintaining your vehicle regularly if you are a car lover.

Why not do the same for other cars in your locality?

You may require some equipment to start, but you will have them for yourselves and receive a return on your investment as you go ahead with your services.

Approach your neighbors to offer basic car maintenance services, such as cleaning, detailing, etc., in your free time.

Related: Get Paid To Advertise On Your Car – 10 Best Ways For 2023

38. Social Media Manager

Income Potential: Earn $20-$30+ per hour

With everyone being more active on social media, businesses or brands have joined the bandwagon to make themselves more approachable to their customers.

While their goal is to keep their existing customers coming back and attract more new customers, not everyone has the skill to do it and may need someone to help them with it.

You will need to do the following things as a part of this side hustle:

- Reply to the followers’ comments

- Attend the inbox messages

- Make creative posts to attract new followers, etc.

The things like replying to messages and comments are something you usually do on your own account, so this might not feel like a typical job, but it still helps you make a side income.

So reach out to possible brands, schedule your timings with them, and get started.

Read: 15 Online Moderator Jobs From Home – ($30 Per Hour)

39. Driving Instructor

Income Potential: An average of $23.07 per hour

There’s an all-time demand for driving instructors, as many people apply for driving licenses each year.

So one with good driving skills and knowledge of what is needed to get a driver’s license easily can offer driving lessons and earn extra money in your pass time.

Additionally, you are required to have the following things to get started as a driving instructor:

- An instructor license

- Certification in training

- Good driving record

- Teaching techniques, etc.

Side Hustles That Pay Weekly

40. Rent Out Your Space On Airbnb

Income Potential: Varies along with your renting space

Make some passive income as you rent that extra space in your house. To those who prefer relaxing after their 9 to 5 job but still want to make money, this can be one of the best side hustle ideas.

Platforms such as Airbnb do the job of attracting guests if you create an account and list your space on their website.

Here’s how you do it:

- Create a Host account on their website

- List your space

- Post photos of it along with a description

- Set up your prices

- And post it

Once your space is rented, you will get paid via Paypal or direct bank deposit within 24 hours. Airbnb charges a small commission of 14% to 16% on our earnings.

41. Rent Out Your Stuff

Income Potential: Depends on the product you rent out

Another way to earn weekly or daily is to rent out unused stuff. There is usually something in our houses that we have stopped using for a long time. Why let it sit idle when it can earn you some bucks?

People who need something, for instance, or travelers, mostly look out for rental stuff. You can reach out to such people to rent your stuff. But how?

Don’t worry; classifieds like Craigslist are always at your rescue for you to list your rental items and get seen by thousands. Starting from a car to clothes, you can rent anything here.

Some other popular places you can rent your stuff include:

- Fat Llama – Rent anything from old antiques to the latest gadgets.

- Style Lend– Rent your style accessories and clothes.

- BabyQuip – For renting baby gear and other baby products.

- Spinlister – To rent out your bike, paddleboard, ski equipment, etc.

If you can invest a small amount, you can buy a few most wanted things and rent them as well.

Read:

- 21 Legit Sites Like Poshmark To Buy Or Sell Stuff

- 17 Best Websites and Apps To Sell Used Clothes Online

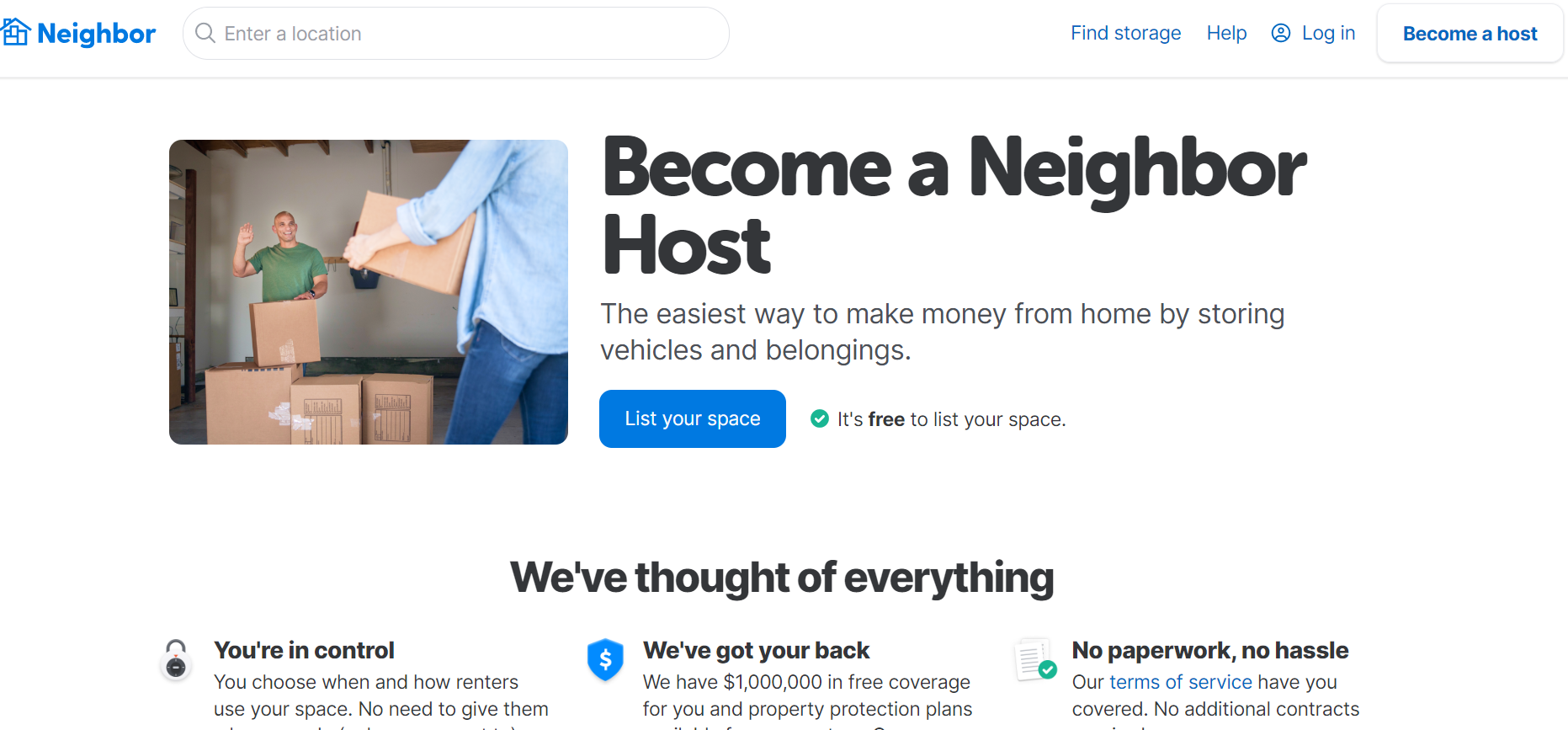

42. Rent Your Free Space On Neighbor

Income Potential: Varies with space

Do you have free space but are not comfortable renting it to strangers to stay?

But still, we have got you covered in terms of making a side income. If you can’t have strangers stay at your place, you can still make money by renting your space to store their goods.

Interesting right?!

You can reach out to people in your locality to offer them to store their things in your free space and make good money using rental platforms like Neighbor.

How Does Renting Out Work?

Neighbor is a peer-to-peer marketplace that connects people with unused storage space and those who need it for storage.

Here you can get paid to store things either in your garage, parking, basement, attic, store room, etc. Your space is secure with their $1,000,000 host liability protection. So you can get started without any hesitation.

You can start by following these three easy steps:

- List your space and mention the prices

- Reply to renters

- Fix a schedule for them to move in

And get your earnings deposited automatically every month to your bank account.

43. Become a Sports Coach

Income Potential: $300 to $800+ per week

Sports are the best way to rejuvenate yourselves after a hectic day. So why not earn some extra cash doing the same?

There are always kids who show interest in learning some sport or the other in our localities. Gather them or find a place where there’s a demand for sports coaching and train them in the sport you are familiar with.

This is going to be triple beneficial because you will get to earn while you enjoy a sport and spend time with kids all at the same time.

Read – 25 Ways to Get Paid to Play Games

44. Landscaping/ Gardening

Income Potential: Earn $250-$800 Per Week

Commonly called gardening, landscaping is all about maintaining or modifying a landscape with different plants and beautifying it.

Most people claim gardening to be a therapy, so don’t miss this therapeutic experience after your day job while you also make a side income.

One can find these opportunities mostly in semi-rural areas, so if you live in a city and don’t mind commuting, this can be your side gig. If you feel it is too much to commute daily, you can do this gig during weekends.

45. Invest In Real Estate

Income Potential: Depends on the market

Investing in real estate is one of the best side hustle ideas you can try anytime, as you don’t need to do anything other than invest money.

This is undoubtedly a heavy investment gig to do, but if you are ready to invest, then this gig has the potential to make you a millionaire.

You also need to have an exceptional grip on the current market trend and analytical skills to succeed in this field.

Finding a genuine real estate agent is a task. Anyhow, we have many trusted platforms, such as Roofstock, for you to fill the gap.

How Does It Work?

Roofstock makes real estate investing seamless for you with its resources no matter in which corner of the world you are. This is a place to buy, manage and sell single-family rentals.

They have a special set of tools that make it easy for you to manage your investments, and they are:

- Free financial management software for investors to save time and money

- Easy sale of your property by making your listing visible to global investors

- Integrated banking and online payments facility

- Courses from experienced real estate investors to guide you.

Related: 22 Fastest Ways To Double Your Invested Money.

Other Side Hustle Ideas Worth Mentioning

How To Turn Your Ideas Into a Hit Side Hustle?

While there are a plethora of side hustles to choose from, you need to work on certain important things before you start so that you can make your side hustle successful for yourselves. They are:

1. Evaluate Your Interests

Side hustles are usually done in free time after a hectic day at work. You do not want to spend your free time doing something that can effortlessly bore you or make you feel mechanical.

So try figuring out what interests you in the first place and make a list of all of them. Now choose that which you are good at doing among those.

This evaluation will help make your side job more fun than a hustle.

2. Do Your Research

The next important thing you should do is to do thorough research about the side job you want to do. Make sure you can reach your goal with the side hustle you are choosing to do.

A few things you need to do in this process involve:

- Talk to those experienced in this job to find the upsides and downsides involved.

- Make a note of any certifications you need to do for the job.

- Refine your skills.

- Get permissions from respective authorities, if any.

- Arrange all the required equipment.

- Check if the gig is worth investing in, even if it is little.

3. Create A Schedule

The next thing is the time factor. You need to be careful about how much time it will take to start and also to keep doing it daily.

If it takes a lot of time to build and start your side job that may clash with your regular job, you should note that it is not worth choosing that job.

Also, make sure that it doesn’t require more than your free time to do this job. It is good to prefer jobs that offer you the flexibility to work whenever you wish so your lifestyle remains undisturbed.

The baseline is that you should exhibit your time management skills and create a daily schedule so you don’t end up messing up.

4. Don’t Overlook Your Regular Job

When we start something new, we commonly show more interest and spend more time on it.

You should be attentive about this thing because you don’t want to ignore your daily job by concentrating more on the new side gig you started.

Otherwise, it may keep you from your main target of making extra income.

You should also not be carried away by success in the initial days of your side gig and neglect your regular job.

Because you never know how the market changes, you need to have a standard monthly income that you will get through your regular 9 to 5 job to be financially safe.

5. Invest Carefully

The most crucial step while considering any side hustle ideas is investing wisely—step in only when you are foolproof that your chosen side job is worth investing your money in.

It may be to learn a course or to build a side business. Either way, you should make sure that you will be getting an assured return on your investment of time and money.

For this, you can study the current market demand or take advice from industry experts.

You should do all the gauging of the income and future potential of the side hustle before starting only because once you are in, you are all in and can’t change anything later.

Once you are certain about all these facets, you can start your side job without apprehensions.

Side Hustle Ideas – Conclusion

‘Things workout best for those who make the best of how things workout’- John Wooden

If everything goes as planned in life, you are likely to slip! Confused? Yes, no matter how many times you read it back, this reality will always not change!

Noble prize winner Ilya Prigogine mentioned in his theory about ‘Dissipative structures’- Contends that friction is the fundamental property of this mother nature, and nothing can be grown well without this. The same applies to our life too.

When your life is hard, your inner intuition works well to make things work out well with the rightful steps with lawful decisions. Rising from ashes is the real achievement that can hail for life with proper self-satisfaction.

Fire it till you wire it!

End of the day, I would like to recommend only one thing- ‘Hustle until you no longer need to introduce yourself.’

Note: I hope this article helps you in making the right choice. Any experienced side hustlers reading this article would appreciate your advice to your co-readers.

Side Hustle Ideas – FAQs

What Are Some Best Side Hustle Ideas Online?

There’s really nothing like good or bad or best side hustle ideas.

But if you want to maintain your peace, then remote jobs such as freelance writing, editing, etc., are the best ones, as you can work from the comfort of your home at any time flexible to you.

You also try some fun time side hustles like taking surveys, watching videos, and playing games to get paid accordingly.

Which Side Hustle Ideas Generate Good Income?

The income for each side hustle varies if you have noticed the earning prospects we have mentioned under each side hustle idea.

But if you are looking to make big, side gigs like blogging, making YouTube videos, etc., yield good money both actively and passively.

Dropshipping, Amazon FBA, and other online selling businesses also generate reliable income if you scale them well.

However, you should note that these gigs require you to invest a lot of time, and if you have the same, then there you go.

Which Side Hustle Ideas Are Best For Me?

The best side hustle idea for you is the one that suits your skills, interests, time, and long-term goal together.

You can always try different gigs before finding the right match for yourself.

How To Manage Time Working On a Side Hustle?

Creating a proper schedule beforehand is vital to managing your time while doing a side hustle.

This schedule should involve everything, such as time for your day job, side job, relaxing, and spending time with your family.

When you have a timetable that covers all these, your goal to make a side income will be justified.

Looking For Other Ways to Make Money Online?

- 35 High-Paying Side Jobs That Pay $80 an Hour

- 30 Best Jobs Where You Work Alone [Up to $50+/Hr]

- 41 Late Night Work At Home Jobs That Pay Well – $1000/Week

Hello there, I’m Siva Mahesh, an MBA Finance post-graduate and a Remote Career & Personal Finance blogger for 5+ years. Over the years, my work has been featured on US News, Entrepreneur, MSN, Yahoo Finance, GoBankingRates, EverQuote, Legal Zoom, The Simple Dollar, Databox, Business.com, Business News Daily, Venngage, Score.org, and more. My primary mission is to help our readers maximize their earning potential with legitimate online business ideas, side hustles, and passive income ideas we publish on Dreamshala. Currently, more than 100,000 readers from all around the world visit this blog every month and learn new ways to improve their finances.